But what factors influence your credit score? Let’s break it down. Poor credit history could lead to higher interest rates, as lenders perceive a higher risk of default.Įxcellent credit scores, conversely, typically secure the best terms and conditions, making it crucial to maintain a high credit score for lower interest payments. This assessment, along with other financial data, dictates your qualification for credit cards or loans. When applying for new credit or loans, creditors evaluate your credit reports and credit scores to assess your creditworthiness. FICO ScoresĪmong various credit scoring models, FICO scores are the most widely utilized by lenders and credit card companies. Having a bad credit score can lead to higher interest rates or being denied credit altogether. The most commonly used credit scores are FICO scores, developed by the Fair Isaac Corporation.įactors that influence your credit score include your payment history, total debt, length of credit history, new credit accounts, and your credit mix. Your credit score is a numerical representation of your creditworthiness, based on the information in your credit report. You should also highlight areas for improvement, such as high credit card balances or late payments. These could include incorrect credit limits, inaccurate payment history, or fraudulent credit accounts opened in your name – a sign of identity theft.

Once you have your credit reports, it’s crucial to review them for errors or discrepancies.

Diy credit sweep free#

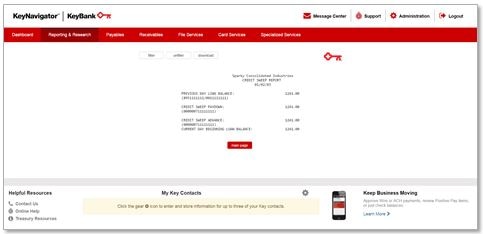

In the United States, there are three major credit bureaus – Experian, TransUnion, and Equifax – and each provides a free credit report once a year through the website. It includes information such as your credit accounts, payment history, and outstanding debts. Understanding Credit ReportsĪ credit report is a detailed summary of your credit history, compiled by a credit bureau. Plus, taking an active role in repairing your credit helps you understand how credit works, which can benefit you in the long run. Doing it yourself means you can avoid these costs and potential pitfalls. Hiring a credit repair company can be expensive, and unfortunately, there are many credit repair scams out there. The most obvious benefit of DIY credit repair is the potential cost savings. Do-It-Yourself Credit Repair: The Benefits You just need a solid understanding of the credit repair process, some organizational skills, and a bit of patience.

Diy credit sweep professional#

While it might seem like an intimidating task, especially if you have a poor credit score, the truth is that many of the strategies used by professional credit repair companies can be implemented by individuals. It’s not an overnight process, but over time, you can see significant improvements in your credit score.

Diy credit sweep series#

What is DIY credit repair?ĭIY credit repair involves a series of steps, starting with obtaining your free credit reports, analyzing them for errors or negative items, disputing any inaccuracies, and then working on strategies to improve your credit health. But, what if your credit is less than stellar? Fortunately, you can engage in do-it-yourself credit repair to improve your financial standing. On the contrary, a poor credit score can close those same doors, making it harder to get a loan or a credit card, and if you do, you’ll likely pay a higher interest rate. A good credit score can open doors, providing you with the best interest rates when you need to borrow money for a home, a car, or any other significant purchase. Understanding and managing your credit is a fundamental part of personal finance.

0 kommentar(er)

0 kommentar(er)